ZATCA-Compliant E-Invoicing Infrastructure for Saudi Enterprises

Phase 2 Integration Ready. Real-Time FATOORAH Connectivity. Enterprise-Scale XML Processing.

SCALE

Processing 1M+ invoices/month

SECURITY

KSA Data Residency & Hybrid Deployment

SPEED

Real-time ZATCA Integration

SMARTeIS E-Invoicing in A Comprehensive Overview

Discover SMARTeIS – a next-gen electronic invoicing solution by Skill Quotient Technologies, engineered for ZATCA compliance and built to scale across the Middle East and beyond.

Whether you’re ensuring ZATCA Phase 2 integration in Saudi Arabia, implementing PEPPOL e-invoicing across the GCC, or managing multi-country tax compliance throughout the Middle East and Asia, SMARTeIS adapts to your regional regulatory requirements.

Already the preferred e-invoicing platform in Singapore and Malaysia, SMARTeIS is now rapidly expanding across the Middle East with dedicated ZATCA-compliant modules for Saudi Arabia and FTA-approved solutions for the UAE-designed for enterprise-scale operations.

Available as both PaaS and SaaS, SMARTeIS deploys instantly, scales on demand, and includes 24×7 expert support with local Middle East specialists—so you can invoice smarter, anywhere in the Kingdom and beyond.# ZATCA-Compliant E-Invoicing Infrastructure for Saudi Enterprises

SCALE

Processing 1M+ invoices/month

SCALE

Processing 1M+ invoices/month

SCALE

Processing 1M+ invoices/month

SMARTeIS Value-Driven Enhancements

A solution engineered with the ZATCA compliance depth, technical precision, and enterprise scalability your organization demands, backed by local Kingdom expertise and international security standards.

Deployment Flexibility

Choose the solution that matches your security and infrastructure requirements: On-Premise for ultimate data control and Saudi data residency compliance or a scalable Cloud-Hosted SaaS model hosted within the Kingdom - both architectured to meet ZATCA technical specifications.

ZATCA FATOORAH Integration

Direct connectivity to ZATCA's FATOORAH platform for Phase 2 compliance. Real-time invoice clearance, cryptographic stamp validation, UUID generation, and seamless integration with the Saudi tax authority's clearance and reporting systems - ensuring zero-delay invoice acceptance.

Guaranteed ZATCA Compliance

Avoid validation failures and penalties. Our platform has pre-configured ZATCA data fields, UBL 2.1 XML schemas, cryptographic stamp requirements, QR code generation, and Phase 2 validation rules to ensure every invoice is accepted the first time by FATOORAH.

Proven Enterprise Scalability

Built for Saudi Arabia's largest enterprises, our platform is proven to handle immense volume, processing over 100,000 invoices per month for major clients across retail, manufacturing, construction, and government sectors throughout the Kingdom.

Powerful Tax Reconciliation Dashboard

Gain clear visibility with real-time reconciliation of tax reported to ZATCA against your ERP records—complete with VAT reporting insights, Zakat calculation support, graphical analytics, and exportable compliance reports formatted for Saudi tax authorities.

Local Expertise & Unmatched Security

Get dedicated support from our Kingdom-based team with deep ZATCA regulatory knowledge. We provide unmatched security and compliance, evidenced by our ISO 27001, SOC 2 Type II certifications, and proven track record across GCC markets with full Saudi data residency compliance.

CONTACT US

Feel free to reach out to us if you need any additional information.

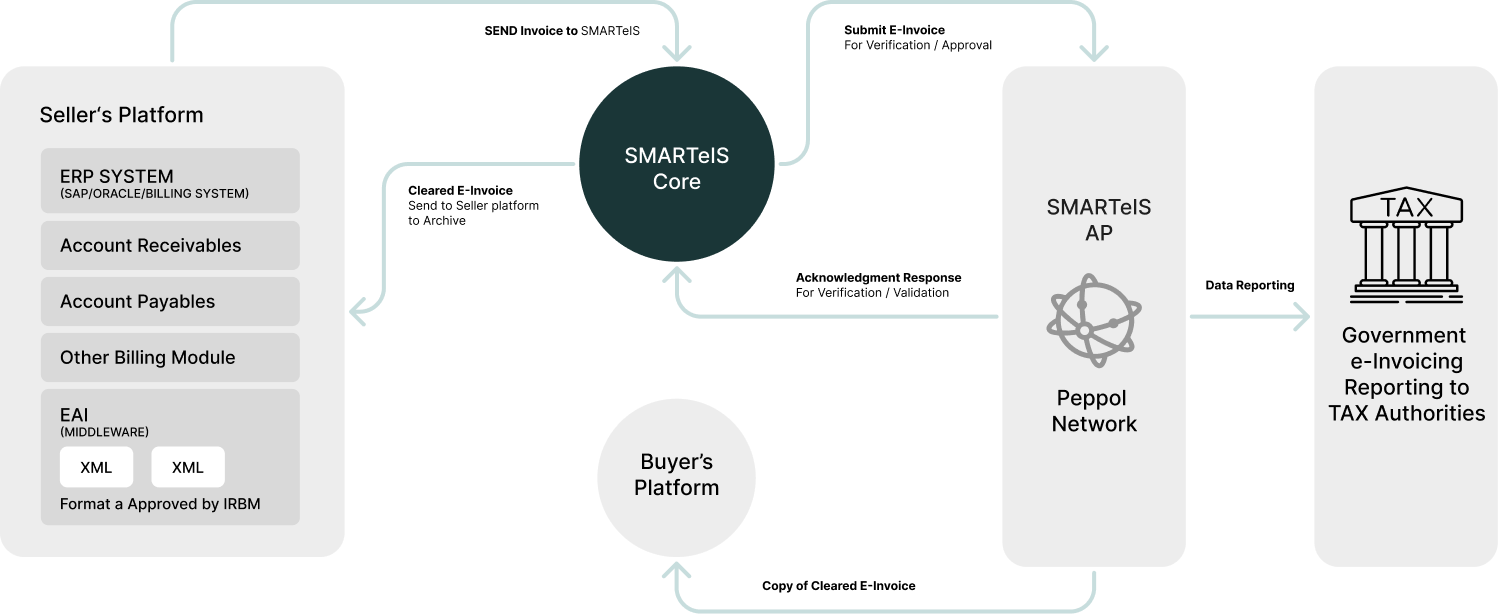

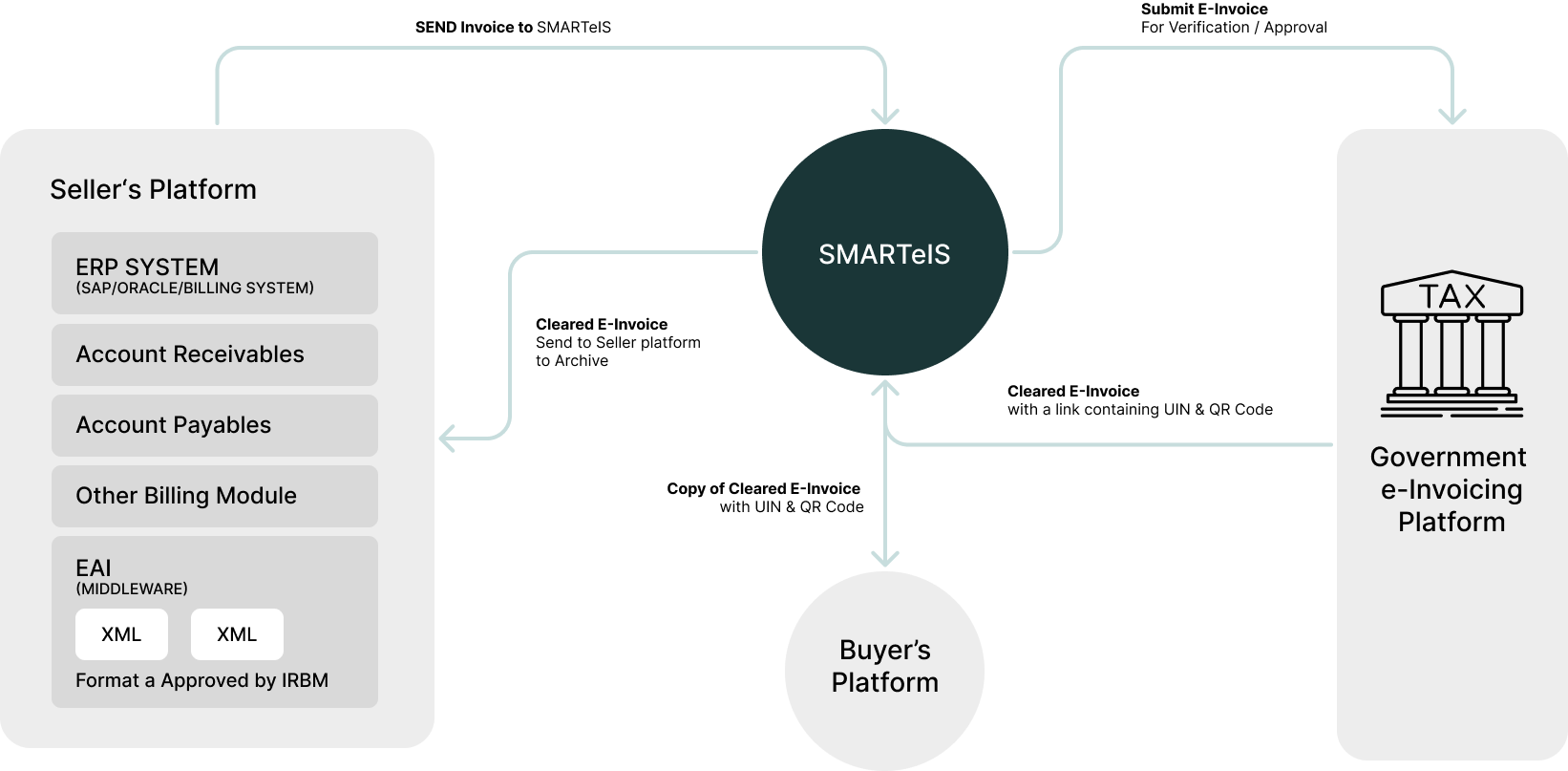

How it works

Connections and Integrations

Why

SMARTeIS

Stand out

Deployment

Flexibility

Choose the solution that matches your security and infrastructure requirements: On-Premise for ultimate data control and Saudi data residency compliance or a scalable Cloud-Hosted SaaS model hosted within the Kingdom—both architectured to meet ZATCA technical specifications.

ZATCA FATOORAH Integration

Direct connectivity to ZATCA's FATOORAH platform for Phase 2 compliance. Real-time invoice clearance, cryptographic stamp validation, UUID generation, and seamless integration with the Saudi tax authority's clearance and reporting systems - ensuring zero-delay invoice acceptance.

Guaranteed ZATCA Compliance

Avoid validation failures and penalties. Our platform has pre-configured ZATCA data fields, UBL 2.1 XML schemas, cryptographic stamp requirements, QR code generation, and Phase 2 validation rules to ensure every invoice is accepted the first time by FATOORAH.

Proven Enterprise Scalability

Built for Saudi Arabia's largest enterprises, our platform is proven to handle immense volume, processing over 100,000 invoices per month for major clients across retail, manufacturing, construction, and government sectors throughout the Kingdom.

Onboarding Process

A clear, structured path to ensure your success from day one.

Discovery

Product demo and a customized proposal for your business.

Setup & Integration

Tenant registration, compliance workshop, and KYC collection.

UAT & Testing

Sandbox enabling and thorough testing to ensure perfection.

Go-Live & Support

Hypercare period and ongoing maintenance with zero cost for regulatory updates.

Frequently Asked Questions

Please feel free to contact us if your question not listed here, we are more than happy to help you

ZATCA’s e-invoicing implementation follows a two-phase approach. Phase 1 (Generation Phase) required all VAT-registered taxpayers to generate compliant e-invoices and e-notes since December 2021. Phase 2 (Integration Phase) mandates real-time integration with ZATCA’s FATOORAH platform for invoice clearance and reporting. ZATCA announces integration requirements in waves based on annual revenue thresholds, typically providing 6 months’ notice. Companies with revenue exceeding SAR 3 million are prioritized in early waves. SMARTeIS, a leading e-invoicing software Saudi Arabia provider, ensures your business is ready for Phase 2 integration with complete ZATCA-compliant e-invoicing infrastructure, cryptographic stamp generation, and real-time FATOORAH connectivity through our trusted e-invoicing solution in Saudi Arabia.

Yes. SMARTeIS, recognized as one of the best e-invoicing software in Saudi Arabia, fully supports both invoice types mandated by ZATCA regulations. Standard Tax Invoices (B2B) include complete buyer details, VAT breakdown, and are subject to clearance through FATOORAH before issuance. Simplified Tax Invoices (B2C) are used for retail transactions under SAR 1,000 and are reported to ZATCA in batch mode rather than cleared individually. The SMARTeIS e-invoice system Saudi Arabia automatically determines the correct invoice type based on transaction parameters, applies appropriate validation rules, generates compliant QR codes for both types, and routes invoices through the correct ZATCA submission channel—ensuring full compliance as an accredited e-invoicing solution provider and trusted electronic invoicing software Saudi Arabia platform.

SMARTeIS, a premier e-invoicing software provider in the Kingdom, includes an integrated Cryptographic Security Module that manages all ZATCA Phase 2 cryptographic requirements. The platform generates and manages X.509 digital certificates, applies cryptographic stamps to invoices before submission, handles certificate lifecycle management including renewal notifications, maintains secure key storage compliant with ZATCA security standards, and validates stamps on received invoices. All cryptographic operations are performed automatically within the electronic invoicing software, eliminating manual certificate management complexity while ensuring your Saudi Arabia e-invoicing solution meets ZATCA’s strict security protocols for invoice integrity and authenticity through our advanced e-invoicing platform Saudi Arabia.

Absolutely. SMARTeIS is designed as a middleware e-invoice system that integrates seamlessly with your existing ERP infrastructure without requiring core system changes. As a leading e-invoicing software Saudi Arabia provider, the platform offers pre-built connectors for SAP (ECC, S/4HANA), Oracle (E-Business Suite, Fusion Cloud), Microsoft Dynamics (365, AX, NAV), and regional ERP systems popular in the Kingdom. Integration is achieved through standard REST APIs, SFTP file exchange, or direct database connectivity. Your finance teams continue working in familiar ERP interfaces while SMARTeIS handles UBL 2.1 XML formatting, ZATCA validation, cryptographic stamping, and FATOORAH transmission—positioning it as a true ZATCA-compliant e-invoicing software that bridges your ERP and regulatory requirements through our proven electronic invoicing solution Saudi Arabia.

SMARTeIS includes a comprehensive Saudi Tax Compliance Engine pre-configured with KSA VAT regulations. As a trusted e-invoicing solution provider Saudi Arabia, the system automatically applies 15% standard VAT rate, handles zero-rated supplies (exports, international transport, certain healthcare), processes exempt transactions (residential property, certain financial services), manages domestic reverse charge mechanisms, calculates VAT on margin schemes, and supports Zakat calculations for Saudi entities. The electronic invoicing software validates tax codes against ZATCA’s approved list, ensures correct tax breakdown in invoice XML, and provides detailed VAT reporting dashboards. This intelligent automation reduces errors and ensures your best e-invoicing software Saudi Arabia maintains perfect alignment with Saudi tax law through our advanced e-invoicing system Saudi Arabia.

SMARTeIS, a leading e-invoicing software provider in Saudi Arabia, implements a robust Error Management & Resolution System for ZATCA compliance. When FATOORAH rejects an invoice, the platform immediately captures the rejection reason with ZATCA error codes, quarantines the failed invoice in a dedicated review queue, sends real-time notifications to relevant users, provides clear guidance on required corrections, and allows for quick invoice amendments and resubmission. The system maintains a complete audit trail of all submission attempts, rejections, and corrections. For common validation errors, SMARTeIS offers automated correction suggestions based on ZATCA rules. This intelligent error handling ensures your ZATCA-compliant e-invoicing operations maintain continuity even when exceptions occur, minimizing business disruption through our reliable e-invoice software Saudi Arabia platform.

Yes. SMARTeIS, recognized as a top e-invoicing solution in Saudi Arabia, is architected for complex organizational structures operating throughout the Kingdom. The platform supports centralized management of multiple legal entities, each with separate VAT registrations, branch-level invoice generation with parent company oversight, entity-specific validation rules and tax configurations, consolidated reporting across all entities for group-level visibility, and inter-company transaction handling with proper tax treatment. Whether you’re managing operations across Riyadh, Jeddah, Dammam, or other regions, SMARTeIS provides headquarters with unified dashboards while maintaining decentralized compliance. This makes it the ideal e-invoicing software provider for Saudi conglomerates, franchises, and multi-branch enterprises seeking the best e-invoicing solution Saudi Arabia offers.

Data sovereignty is built into SMARTeIS’s architecture for the Saudi market. As a compliant electronic invoicing software Saudi Arabia provider, all invoice data, validation logs, cryptographic keys, and tax records for Saudi entities are processed and stored exclusively within Kingdom-based infrastructure—either in Saudi cloud data centers or your on-premise deployment. The platform enforces strict data residency policies preventing cross-border data transfer, maintains compliance with Saudi data protection regulations, provides data localization certificates for regulatory audits, and ensures ZATCA can access required data for compliance verification. This commitment to Saudi data residency makes SMARTeIS a trusted e-invoicing software in Saudi Arabia that respects the Kingdom’s sovereignty requirements while delivering global-standard security through ISO 27001 and SOC 2 Type II certifications as a reliable e-invoice system Saudi Arabia solution.

SMARTeIS, a premier e-invoicing solution provider in Saudi Arabia, offers comprehensive onboarding support specifically designed for ZATCA Phase 2 integration. Our Implementation Program includes: initial ZATCA compliance assessment and gap analysis, detailed project plan aligned with your wave deadline, technical workshop covering cryptographic stamps, UBL 2.1, and FATOORAH integration, ERP connector configuration and testing, sandbox environment for thorough testing before production, ZATCA Compliance Security Features Conformance Certificate (CCSFC) application support, production go-live assistance with hypercare period, and ongoing regulatory updates at no additional cost. Our Kingdom-based implementation team has successfully onboarded dozens of Saudi enterprises through Phase 2, ensuring your e-invoicing software Saudi Arabia deployment is smooth, compliant, and business-ready as the top e-invoicing solution Saudi Arabia provides.

ZATCA regulations continue to evolve with new technical specifications, validation rules, and compliance requirements. SMARTeIS, recognized as the best e-invoicing software in Saudi Arabia, maintains a dedicated ZATCA Compliance Center that continuously monitors all regulatory updates from ZATCA, Saudi tax law changes, FATOORAH platform enhancements, and new wave announcements. When regulations change, our compliance team updates the platform’s validation engines, UBL schemas, cryptographic protocols, and business rules—these updates are automatically deployed to all clients without requiring manual intervention or system downtime. You receive advance notification of significant changes with clear implementation guidance. This proactive regulatory management ensures your ZATCA-compliant e-invoicing infrastructure remains current as the Kingdom’s digital transformation evolves, protecting your business from compliance risks through our trusted electronic invoicing software Saudi Arabia and comprehensive e-invoicing platform Saudi Arabia.

CONTACT US

Feel free to reach out to us if you need any additional information.

A year with SMARTeIS has transformed our invoicing at Geodis Malaysia — automated ERP-to-tax flows, validated QR codes, and near-zero reconciliation, supported by strong implementation and service.

4.8*

Cheng Han Chee

Finance Director, Geodis

SQ exceeded expectations during our e-invoicing implementation — responsive, committed, and supportive through go-live. We’re confident in a successful completion.

4.8*

Mark Chan Keat Jin

SVP, Group Head of Tax, MNRB Holdings Berhad

2.5k

Successfully complete

the case study.