Global E-invoicing Solution for Modern Enterprises

Comply with local mandates worldwide through a single, unified platform

100+

Clients across APAC, MENA and EU

Scale

Processing 40M+ invoices per year.

Security

Encrypted and Cyber Secured.

Speed

Real-time Validation (<200ms latency).

Our Accreditations

With tax authorities across the globe

MOF

MoF-Aligned, PEPPOL-Based e-invoicing Service Provider (PINT-AE Ready)

- UAE

MDEC

Certified Service Provider

- MALAYSIA

IMDA

- SINGAPORE

BOSA

Registered e-invoice Compliant Software

- BELGIUM

GSP

- INDIA

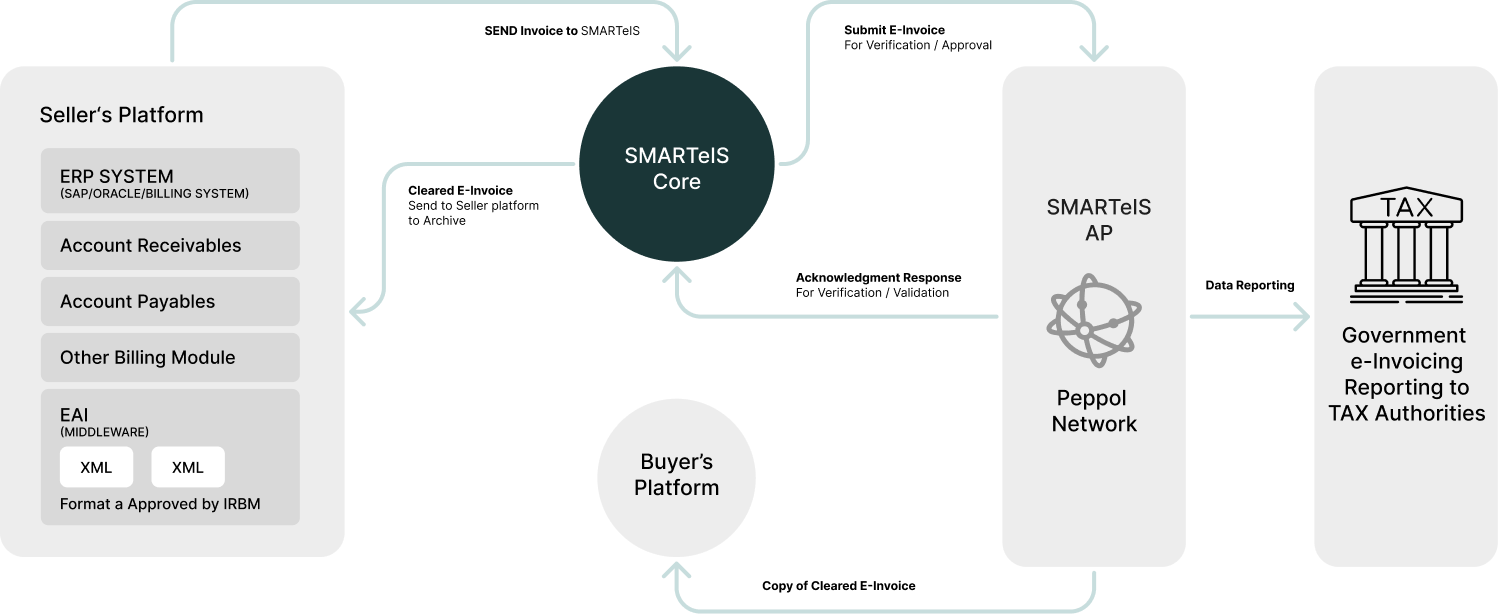

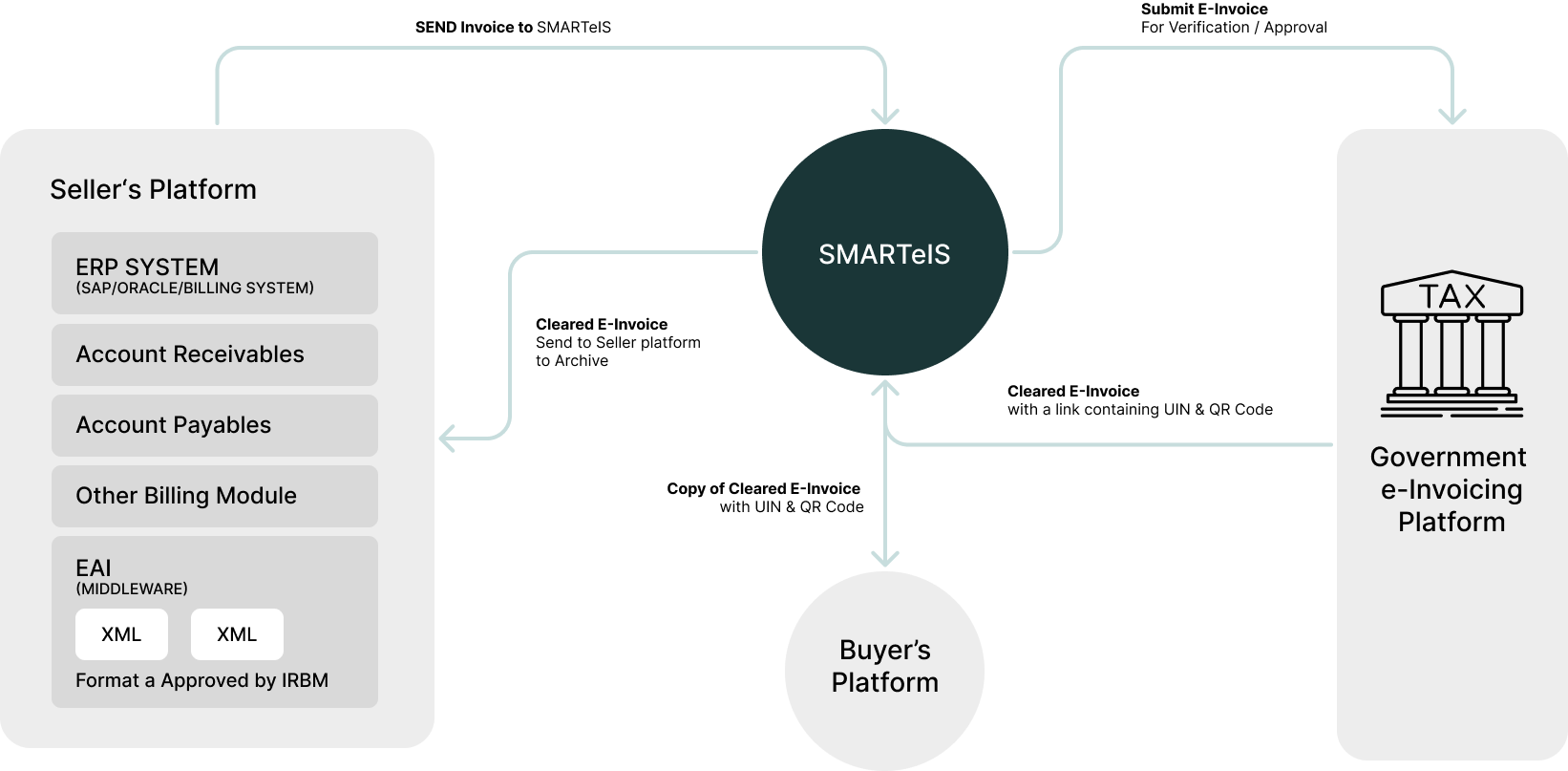

SMARTeIS e-invoicing in A Comprehensive Overview

Discover SMARTeIS, a next-gen electronic invoicing solution by Skill Quotient Technologies, built on globally trusted Peppol e-invoicing standards.

Whether you’re ensuring full compliance across Europe, integrating with ERP systems for smooth billing in Asia, or meeting evolving tax regulations in the Middle East, SMARTeIS adapts to your regional needs.

Already the preferred e-invoicing platform in Singapore and Malaysia, SMARTeIS is now gaining rapid traction in the UAE with a dedicated Peppol e-invoicing UAE module designed for compliance and scale.

Available as both PaaS and SaaS, SMARTeIS deploys instantly, scales on demand, and includes 24×7 expert support so you can invoice smarter, anywhere in the world.

Connections and Integrations

Why

SMARTeIS

Stands out

Deployment

Flexibility

On-Premise for full data control or Cloud-Hosted SaaS for scalability, speed, and seamless integration with your existing infrastructure.

Dual Connectivity Architecture

SMARTeIS supports Peppol and non-Peppol frameworks, ensuring full e-invoicing compliance and readiness without vendor lock-in.

Local Expertise & Unmatched Security

Get support from our local team. SMARTeIS is a trusted e-invoicing Partner, ISO 27001, SOC 2 Type II, and Peppol Certified.

Proven Enterprise Scalability

Built for scale, SMARTeIS processes 100,000+ monthly invoices, making it a top choice for large UAE enterprises.

Frequently Asked Questions

Please feel free to contact us if your question not listed here, we are more than happy to help you

SMARTeIS is a unified global electronic invoicing software with country-specific compliance modules. Connect your ERP once to this e-invoice system, and it automatically applies FTA-compliant e-invoicing rules in UAE, integrates with LHDN Malaysia, and routes invoices via PEPPOL e-invoicing (InvoiceNow) Singapore—making it a scalable e-invoicing solution provider for global enterprises.

PEPPOL e-invoicing delivers a secure, standardized, and interoperable framework that email-based invoicing cannot match. Invoices are exchanged in machine-readable XML directly between certified e-invoicing systems, eliminating manual data entry, reducing errors, and significantly lowering the risk of invoice fraud. This structured exchange accelerates payment cycles, improves reconciliation, and supports B2G e-invoicing mandates, making PEPPOL the preferred global standard for compliant electronic invoicing.

SMARTeIS supports the PINT (Peppol International Invoice) standard to enable secure cross-border PEPPOL e-invoicing. As a unified electronic invoicing software, it automatically formats invoices to international standards while applying country-specific tax rules for the exporting jurisdiction. The SMARTeIS e-invoice system manages multi-currency conversion, cross-border tax code mapping, and structured XML exchange, helping enterprises ensure global compliance, reduce errors, and scale international invoicing operations efficiently.

SMARTeIS follows an ERP-agnostic e-invoicing architecture. A single integration—via API, SFTP, or standard ERP connector—connects your global SAP or Oracle instance to the SMARTeIS platform.

All country-specific e-invoicing compliance, such as India e-Invoicing, Malaysia IRBM, Singapore (Peppol/IMDA), Belgium (Peppol), and UAE (FTA / PINT-AE), is managed within the SMARTeIS middleware, not within the ERP.

This approach keeps the global ERP instance clean, eliminates the need for country-specific plugins, reduces ongoing regulatory maintenance, and enables SMARTeIS to scale as a single e-invoicing solution for multinational compliance

SMARTeIS is built on a regionally distributed electronic invoicing software architecture with configurable data residency policies. Data for European entities is processed and stored within EU-based data centers to meet GDPR compliance. At the same time, countries with strict residency laws, such as Saudi Arabia or China, are handled locally. This secure e-invoice system ensures regulatory compliance, supports global operations, and provides centralized visibility for headquarters through a trusted e-invoicing solution provider.

SMARTeIS provides real-time tax analytics, AI-powered validations, and automated tax reporting, helping businesses meet VAT and regulatory requirements while reducing compliance risks.

SMARTeIS accelerates supplier onboarding through the Peppol Directory, enabling instant connectivity across the global PEPPOL e-invoicing network. By publishing a unique Peppol ID, suppliers in 40+ countries can exchange invoices without custom EDI integrations. The SMARTeIS electronic invoicing software and e-invoice system ensure structured XML exchange, regulatory compliance, and faster adoption. For non-Peppol suppliers, a secure Supplier Portal enables PO-to-invoice conversion, positioning SMARTeIS as a scalable e-invoicing solution provider.

Absolutely. SMARTeIS includes a robust Global Validation Engine built into its electronic invoicing software. Before any invoice is transmitted to government platforms such as LHDN Malaysia or Saudi ZATCA, data passes through the SMARTeIS e-invoice system for mandatory field checks, tax code mapping, mathematical accuracy, and XML schema compliance. Invalid invoices are blocked and returned for correction, ensuring FTA-compliant e-invoicing, reducing audit risks, and positioning SMARTeIS as a trusted e-invoicing solution provider.

Yes. SMARTeIS includes a secure Global Digital Archive within its electronic invoicing software. Businesses can configure country-specific retention policies—such as 7 years for Malaysia or 10 years for Germany—to meet local compliance requirements. All invoices are stored in their original structured e-invoice formats (XML/JSON) along with validation artifacts, digital signatures, and government clearance IDs, ensuring audit-ready e-invoicing, regulatory compliance, and trusted record management through a centralized e-invoice system.

Yes. SMARTeIS is a modular SaaS electronic invoicing software designed to scale globally. As your business expands into new markets—such as Poland’s KSeF or France’s PDP e-invoicing framework—you can instantly activate the required country-specific compliance module within the SMARTeIS e-invoice system. New mandates are continuously added as regulations evolve, ensuring ongoing compliance, reduced implementation effort, and a future-proof e-invoicing solution that adapts seamlessly to global regulatory changes.

CONTACT US

Feel free to reach out to us if you need any additional information.

Success stories of our customers!

A year with SMARTeIS has transformed our invoicing at Geodis Malaysia — automated ERP-to-tax flows, validated QR codes, and near-zero reconciliation, supported by strong implementation and service.

Cheng Han Chee

Finance Director, Geodis

Success stories of our customers!

SQ exceeded expectations with a responsive, committed team that ensured a smooth e-invoicing implementation through go-live. With continued collaboration, we’re confident in a successful and stable rollout.

Mark Chan Keat Jin

SVP, Group Head of Tax, MNRB Holdings Berhad