As the UAE embarks on its journey towards mandatory e-invoicing, businesses are transitioning to a more efficient, transparent, and digitally enabled economy. The UAE government’s adoption of the Peppol Continuous Transaction Control (CTC) model for e-invoicing marks a significant step in this transformation, and SMARTeIS is here to help your business stay ahead.

The Peppol CTC model is a decentralized e-invoicing system that enables real-time invoice exchange between businesses and the UAE tax authority, ensuring VAT compliance through a five-corner structure.

SMARTeIS is a PEPPOL-accredited e-invoicing solutions provider, offering businesses in the UAE and beyond a comprehensive platform to manage their electronic invoices. Our solution seamlessly integrates with the Peppol CTC framework, enabling businesses to comply with the UAE government’s mandate and benefit from automated invoicing, real-time reporting, and secure data transmission.

Whether you’re in energy, oil & gas, banking, insurance, IT, or any other industry, SMARTeIS is your trusted partner in digitizing invoicing processes. We understand the challenges of adapting to new regulations, and we are committed to ensuring a smooth transition to the Peppol CTC model for all businesses, regardless of size or sector.

Don’t wait for the deadline — get ahead of the curve with SMARTeIS. Our team is ready to help you transition to e-invoicing quickly and seamlessly, ensuring compliance with UAE’s new regulations and helping your business stay competitive in a digital-first world.

Contact us today to learn more about how SMARTeIS can streamline your invoicing process and ensure a smooth transition to the Peppol CTC framework. Fill out the form below, and our experts will guide you through the process!

UAE e-Invoicing is a system mandated by the Federal Tax Authority (FTA) for businesses to generate and exchange invoices electronically. It replaces traditional paper or PDF invoices with structured digital formats. This ensures higher transparency, faster validation, and regulatory compliance.

An e-Invoice is a digitally generated invoice in a machine-readable format approved by UAE authorities.

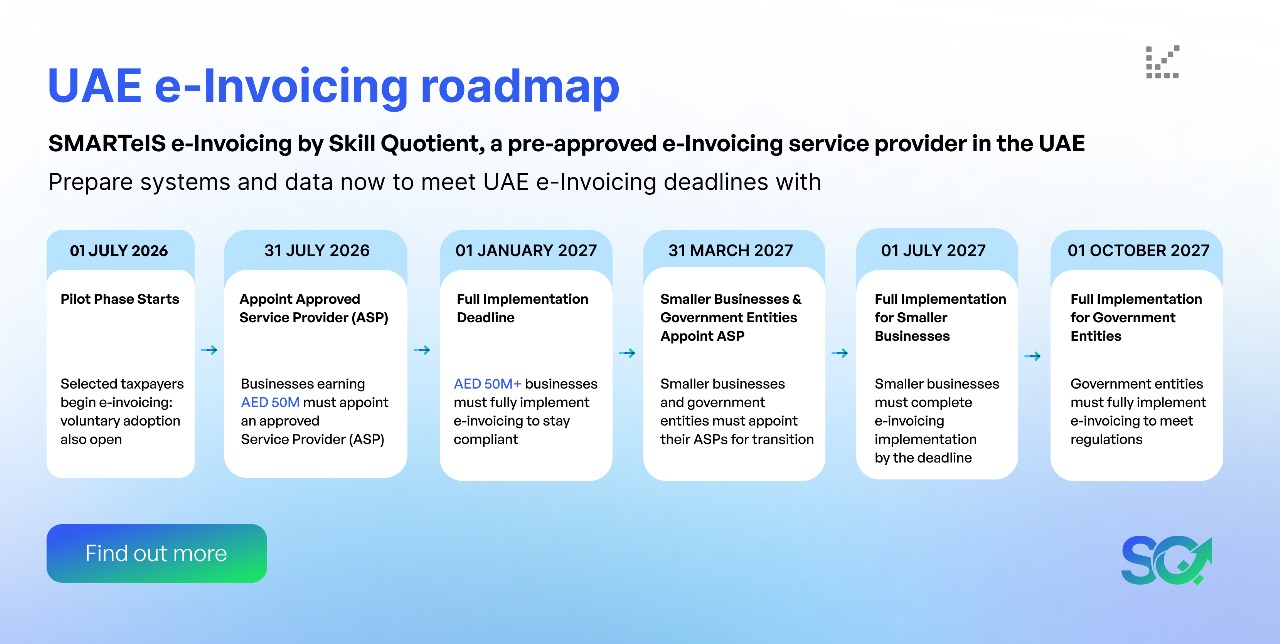

In the UAE, e-Invoicing will be introduced in phases. The process begins with a pilot program on July 1, 2026, followed by the first mandatory phase on January 1, 2027, for businesses with annual revenues of AED 50 million or more. Companies with revenues below AED 50 million will be required to comply starting July 1, 2027. This phased rollout applies to both business-to-business (B2B) and business-to-government (B2G) transactions.

The UAE model is built specifically around the country’s VAT and compliance requirements. It ensures invoices follow the mandated structure and are validated through approved platforms. SMARTeIS is designed to align directly with these requirements, ensuring seamless compliance.

SMARTeIS by Skill Quotient is purpose-built for the UAE market, aligning with the upcoming Federal Tax Authority (FTA) e-invoicing mandates. It offers a one-stop platform for compliance, automation, and seamless integration with ERP/accounting systems. With in-house expertise in UAE VAT regulations and global PEPPOL standards, SMARTeIS ensures businesses stay fully compliant while simplifying operations. Its proven track record in the region helps UAE companies reduce costs, minimize compliance risks, and achieve a smooth transition to digital invoicing.

ZATCA approval ensures that businesses in Saudi Arabia can legally issue compliant e-Invoices. It reduces the risks of penalties and builds confidence with regulators. For multinational firms, it also simplifies cross-border compliance.

Different ERPs and systems generate data in varied formats. A Data Converter standardizes this before submission. Without it, integration and compliance can fail.

Payment automation digitizes the end-to-end payment cycle, from approvals to disbursement. It ensures payments are processed securely and on time. Companies benefit from reduced errors, cost savings, and improved vendor satisfaction.

It validates and restructures data to avoid mismatches or errors. By formatting before accuracy checks, it ensures smooth invoice processing. This reduces rejection rates during compliance checks.

Tax Transformation Compliance Solutions are comprehensive tools that help businesses adapt to new tax frameworks and remain compliant. These solutions automate manual tasks, reduce human error, and streamline reporting to regulatory authorities.

Let SMARTeIS help you future-proof your invoicing process, boost compliance, and increase operational efficiency with our PEPPOL-enabled, AI-powered e-invoicing solution.

Skill Quotient Technologies © 2025. All rights reserved.

Ask about Smarteis