PEPPOL-Certified E-Invoicing Platform for Pan-European Enterprise Operations

EU Data Sovereignty. Cross-Border Compliance. Unified Platform for Multi-Country VAT Reporting.

SCALE

High-throughput & batch

SECURITY

EU data residency

SPEED

Real-time Peppol

SMARTeIS E-Invoicing in A Comprehensive Overview

Whether you’re ensuring full compliance across Europe, integrating with ERP systems for smooth billing in Asia, or meeting evolving tax regulations in the Middle East, SMARTeIS adapts to your regional needs.

Already the preferred e-invoicing platform in Singapore and Malaysia, SMARTeIS is now gaining rapid traction in the UAE with a dedicated Peppol e-Invoicing UAE module designed for compliance and scale.

Available as both PaaS and SaaS, SMARTeIS deploys instantly, scales on demand, and includes 24×7 expert support—so you can invoice smarter, anywhere in the world.

SCALE

Processing 1M+ invoices/month

SCALE

Processing 1M+ invoices/month

SCALE

Processing 1M+ invoices/month

SMARTeIS Value-Driven Enhancements

Built for Belgium’s B2B e-invoicing mandate and EU ViDA alignment, delivering precision, interoperability, and centralized control for finance and tax operations.

Deployment Flexibility

Choose an On-Premise e-invoice system like SMARTeIS by Skill Quotient for complete data sovereignty or a scalable EU Cloud-Hosted SaaS electronic invoicing software — both architected to meet GDPR, NIS2, and multi-country European compliance requirements.

Pan-European PEPPOL Connectivity

Operate seamlessly across the PEPPOL Network with certified Access Point status. Connect with government platforms (Chorus Pro, FatturaPA, e-rechnung) and private entities across 40+ countries through standardized, interoperable infrastructure - eliminating vendor lock-in and future migration risks.

Guaranteed Multi-Country Compliance

As a PEPPOL-certified e-invoicing software provider, SMARTeIS includes pre-configured validation for EU member states: Belgium's UBL-CIUS formats, French Chorus Pro specifications, Italian FatturaPA schemas, German XRechnung/ZUGFeRD standards, and ViDA directive requirements — ensuring first-time invoice acceptance across jurisdictions.

Proven Enterprise Scalability

SMARTeIS by Skill Quotient processes over 100,000 invoices per month for major European enterprises, making it one of the most trusted e-invoicing solutions in Europe for multinational corporations, cross-border supply chains, and government-linked entities.

Advanced EU VAT Reconciliation Dashboard

Real-time reconciliation between ERP data and country-specific VAT submissions — complete with VIES validation, intra-community supply tracking, OSS reporting insights, and exportable compliance reports formatted for European tax authorities.

European Expertise & Certified Security

Backed by EU-based compliance specialists with deep knowledge of European tax regulations. Certified for ISO 27001, SOC 2 Type II, PEPPOL Service Provider accreditation, and fully compliant with GDPR, ePrivacy Directive, and NIS2 cybersecurity requirements for data protection and residency.

CONTACT US

Feel free to reach out to us if you need any additional information.

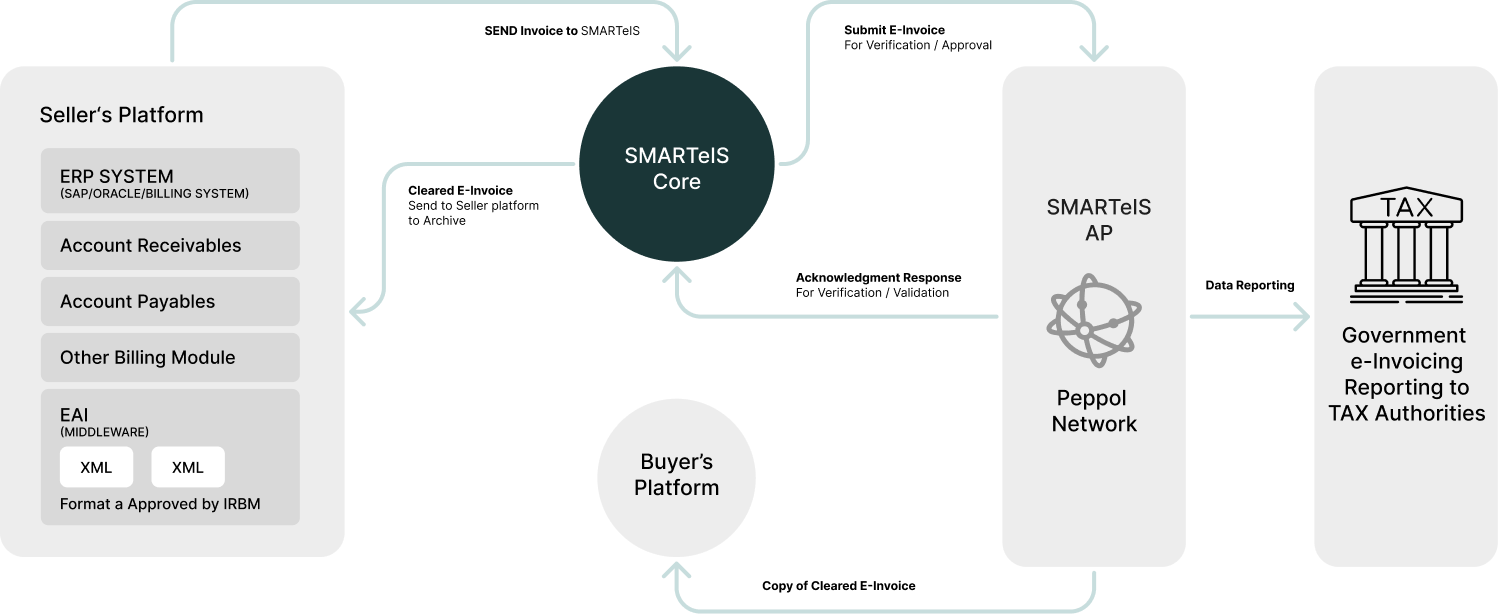

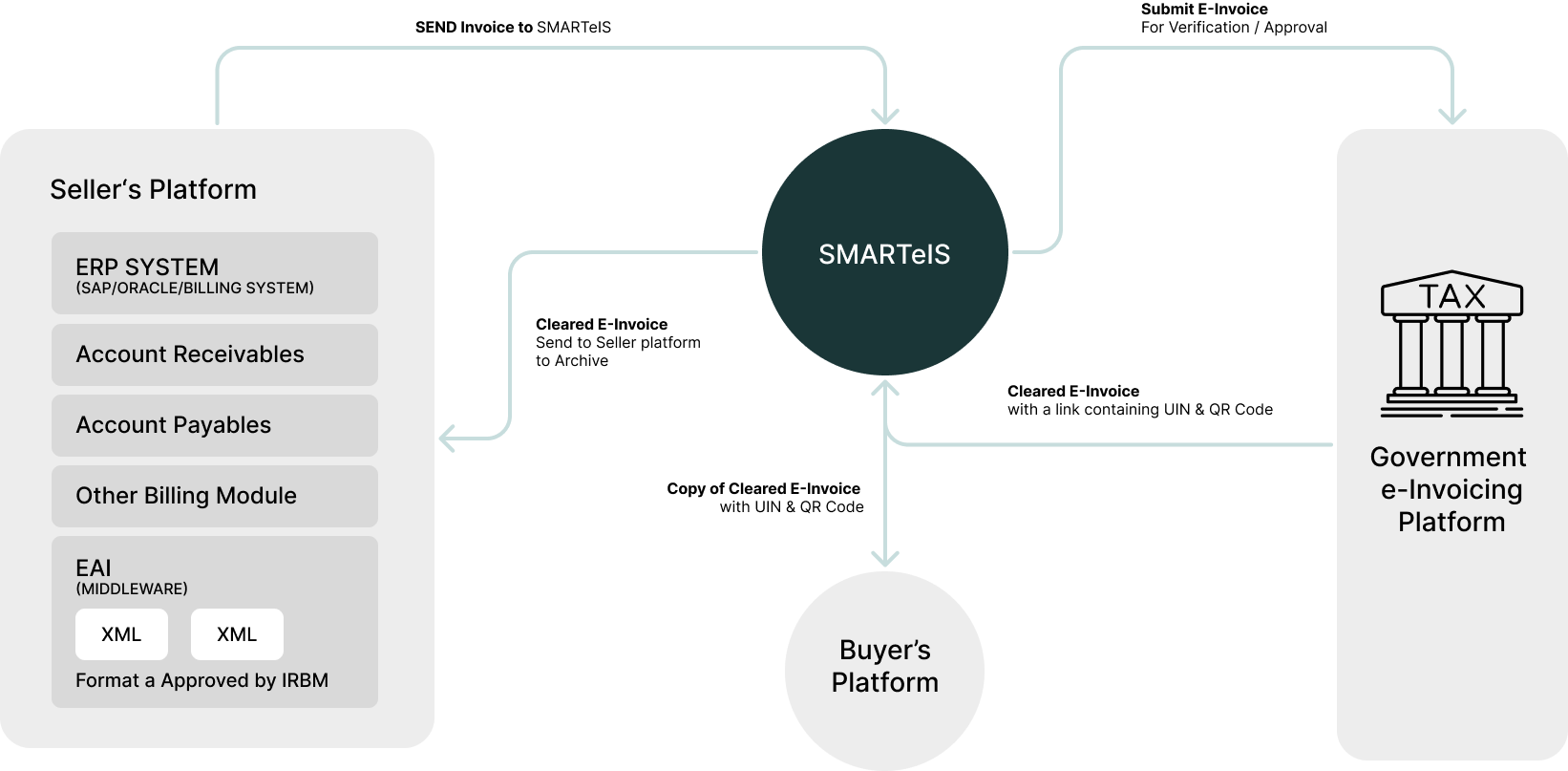

How it works

Connections and Integrations

Why

SMARTeIS

Stand out

Deployment

Flexibility

options—On-Premise for full data control or Cloud-Hosted SaaS for scalability, speed, and seamless integration with your existing infrastructure.

Dual Connectivity Architecture

SMARTeIS supports Peppol and non-Peppol frameworks, ensuring full e-invoicing compliance and readiness without vendor lock-in.

Local Expertise & Unmatched Security

Get support from our local team. SMARTeIS is a trusted E-Invoicing Partner, ISO 27001, SOC 2 Type II, and Peppol Certified.

Proven Enterprise Scalability

Built for scale, SMARTeIS processes 100,000+ monthly invoices, making it a top choice for large UAE enterprises.

Onboarding Process

A clear, structured path to ensure your success from day one.

Discovery

Product demo and a customized proposal for your business.

Setup & Integration

Tenant registration, compliance workshop, and KYC collection.

UAT & Testing

Sandbox enabling and thorough testing to ensure perfection.

Go-Live & Support

Hypercare period and ongoing maintenance with zero cost for regulatory updates.

Frequently Asked Questions

Please feel free to contact us if your question not listed here, we are more than happy to help you

PEPPOL (Pan-European Public Procurement Online) is a standardized framework for secure, interoperable electronic document exchange across borders. As a certified PEPPOL Access Point, SMARTeIS enables businesses to send and receive structured invoices with government entities and private companies across 40+ countries using a single electronic invoicing software platform. PEPPOL eliminates the need for multiple proprietary EDI connections, reduces integration costs, and ensures compliance with European e-invoicing mandates through standardized UBL (Universal Business Language) formats.

SMARTeIS is architected with EU data sovereignty as a core principle. All invoice data for European entities is processed and stored exclusively within EU-based data centers, ensuring full compliance with GDPR, the ePrivacy Directive, and NIS2 cybersecurity requirements. The platform includes automated data subject access request (DSAR) workflows, encryption at rest and in transit, audit trails for data processing activities, and configurable data retention policies aligned with each country’s statutory requirements. As a trusted e-invoicing software provider, SMARTeIS undergoes regular third-party audits for ISO 27001 and SOC 2 Type II compliance.

Absolutely. SMARTeIS is designed for complex multinational operations. The platform supports centralized management of multiple legal entities, each with country-specific VAT registrations, tax codes, and compliance rules. Whether you’re operating subsidiaries in Belgium, France, Germany, Netherlands, or Spain, SMARTeIS automatically applies the correct validation rules, formats (UBL-CIUS, Factur-X, XRechnung, FatturaPA), and routing logic for each entity. This e-invoice system provides headquarters with consolidated visibility while maintaining decentralized compliance at the local level.

SMARTeIS includes an advanced EU VAT Compliance Engine that automates complex cross-border scenarios. The platform validates VAT numbers in real-time against the EU VIES (VAT Information Exchange System) database, automatically determines the correct VAT treatment for intra-community supplies, applies reverse charge mechanisms where applicable, and generates country-specific recapitulative statements (EC Sales Lists). For businesses using the One Stop Shop (OSS) scheme, SMARTeIS aggregates and formats data for simplified VAT reporting across multiple member states.

SMARTeIS provides native connectivity to major European e-invoicing platforms including Belgium’s PEPPOL network for B2G invoicing, France’s Chorus Pro for public sector procurement, Italy’s Sistema di Interscambio (SDI) for FatturaPA submission, Germany’s emerging e-rechnung infrastructure (XRechnung/ZUGFeRD), Spain’s FACe platform, and the Netherlands’ Digipoort gateway. As an accredited PEPPOL Service Provider, the electronic invoicing software also enables direct exchange with thousands of private sector participants across the PEPPOL network without requiring individual bilateral agreements.

Yes. SMARTeIS acts as a compliance middleware layer that integrates seamlessly with your existing ERP infrastructure without requiring core system modifications. The platform offers pre-built connectors for SAP (ECC, S/4HANA), Oracle (E-Business Suite, Fusion Cloud), Microsoft Dynamics (365, AX, NAV), Exact (Globe, Online), Sage, Odoo, and other enterprise systems. Integration is achieved through standard APIs, SFTP file exchange, or direct database connectivity. Your finance teams continue working in familiar ERP interfaces while SMARTeIS handles format conversion, validation, digital signatures, and transmission to European tax authorities and trading partners.

Implementation timelines vary based on organizational complexity, but typical deployments follow this structure: Discovery & Planning (2-3 weeks) — requirements gathering, compliance workshop, technical architecture design; Configuration & Integration (4-6 weeks) — ERP connector setup, entity-specific validation rules, user acceptance testing; Pilot & Go-Live (2-4 weeks) — phased rollout starting with one entity, hypercare support, production transition. For large enterprises with 10+ entities across multiple countries, full implementation typically ranges from 3-6 months. SMARTeIS’s modular architecture allows you to start with high-priority entities and progressively onboard others.

Regulatory updates are included at no additional cost. SMARTeIS maintains a dedicated European Compliance Center that continuously monitors regulatory changes across all EU member states, including new e-invoicing mandates, updated validation rules, format specifications, and ViDA directive developments. When regulations change, our compliance team updates the platform’s validation engines, format templates, and routing logic — these updates are automatically deployed to all clients without requiring manual intervention or system downtime. This ensures your e-invoicing solution remains compliant as the European landscape evolves.

SMARTeIS includes a comprehensive European Digital Archive with country-specific retention policies. The system automatically stores invoices in their original structured formats (UBL XML, FatturaPA XML, XRechnung, Factur-X) along with validation responses, digital signatures, transmission logs, and government clearance confirmations. Retention periods are configurable per country (7 years for Belgium, 10 years for Germany, 10 years for Italy, etc.) to meet local statutory requirements. All archived documents are searchable, tamper-proof, and can be retrieved instantly for tax audits or compliance reviews. The archive maintains a complete chain of custody with timestamps, user actions, and system events to satisfy European tax authority expectations.# Key Differentiators for the European Market

SMARTeIS is built on a CTC-first architecture designed to handle both current clearance models (e.g., Italy’s SDI, Poland’s KSeF, and France’s PDP ecosystem) and the upcoming ViDA (VAT in the Digital Age) digital reporting framework. The platform orchestrates real-time invoice validation, government clearance, status polling, response management, and reconciliation without user intervention. For intra-EU B2B transactions, SMARTeIS automatically generates structured datasets aligned with ViDA’s Phase 1 reporting schema for cross-border supplies and supports digital signature, timestamping, and UBL conformity. The Compliance Engine ensures seamless coexistence between clearance, post-audit, and hybrid models across Europe, enabling businesses to adapt as member states transition to CTC/DR models through 2028 and beyond.

CONTACT US

Feel free to reach out to us if you need any additional information.

A year with SMARTeIS has transformed our invoicing at Geodis Malaysia — automated ERP-to-tax flows, validated QR codes, and near-zero reconciliation, supported by strong implementation and service.

4.8*

Cheng Han Chee

Finance Director, Geodis

SQ exceeded expectations during our e-invoicing implementation — responsive, committed, and supportive through go-live. We’re confident in a successful completion.

4.8*

Mark Chan Keat Jin

SVP, Group Head of Tax, MNRB Holdings Berhad

2.5k

Successfully complete

the case study.